Posted on

June 19, 2025

by

Michael Englund

The High Cost of Waiting: What $5,000/Month in Rent Really Means in Today’s Market

In today’s real estate market across Oakville, Milton, and Burlington, many would-be buyers are sitting on the sidelines—renting and hoping that home prices will drop before they jump in.

Let’s take a common scenario: a buyer currently renting for $5,000/month, holding out for a $2,000,000 detached home to become more “affordable.” That’s $60,000 spent on rent over the course of a year. So, did the market give them that $60,000 price break they were hoping for?

Well, not quite.

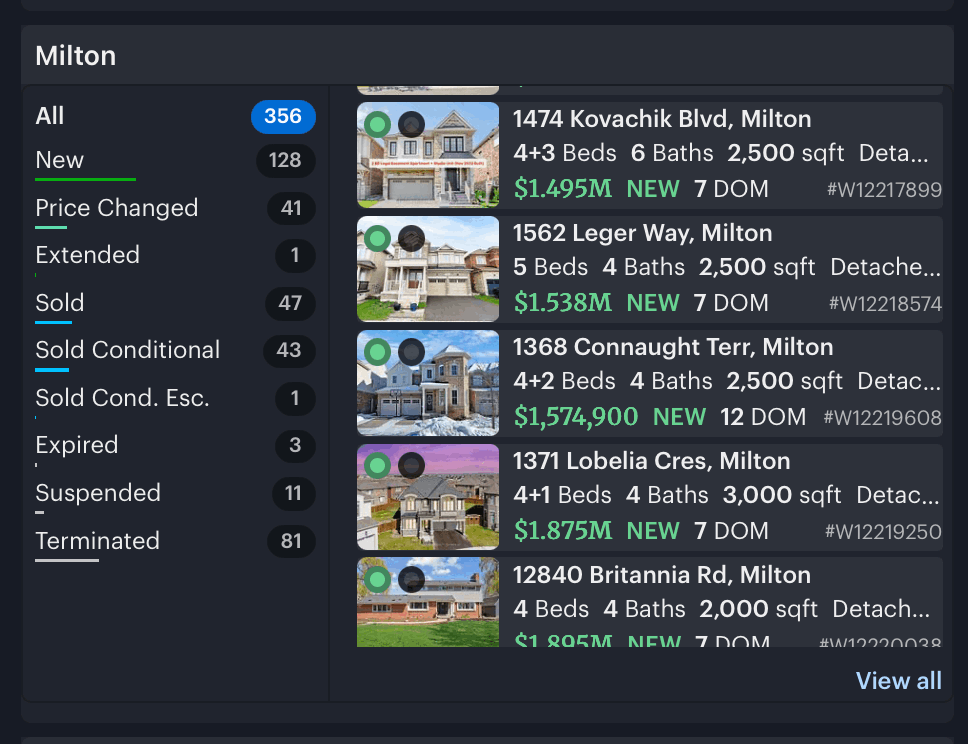

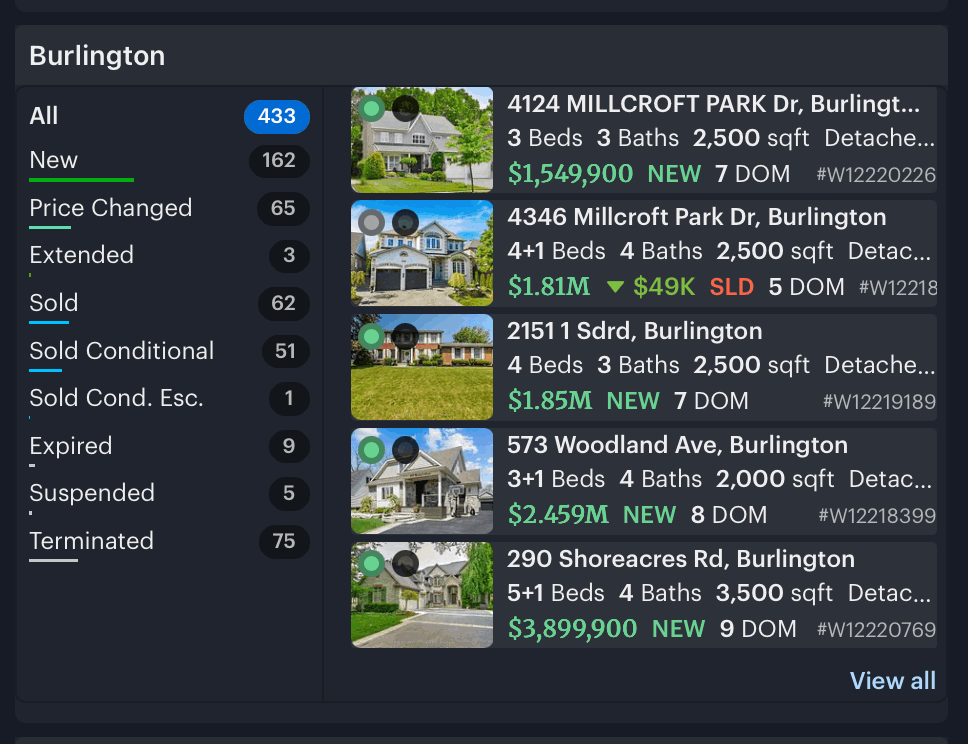

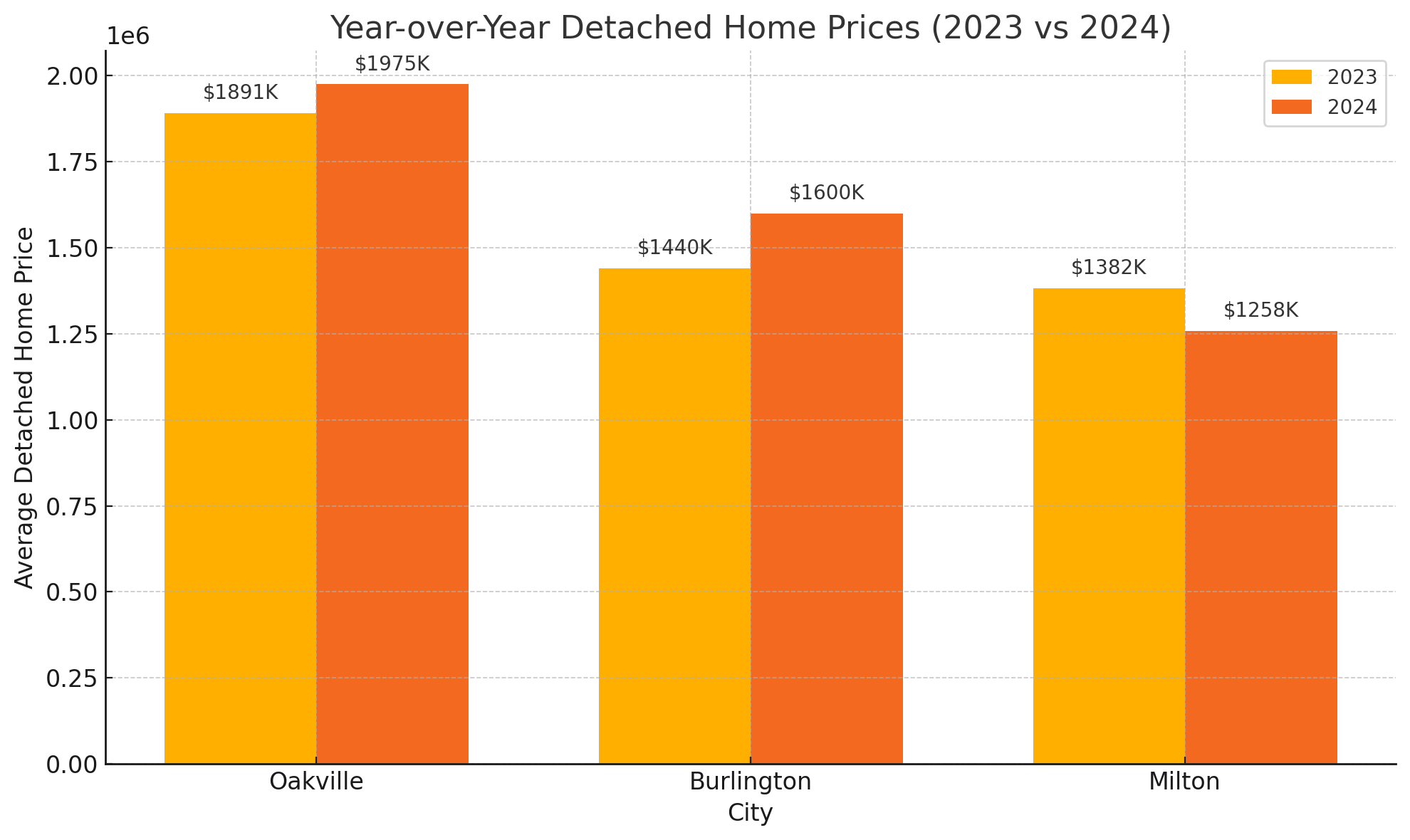

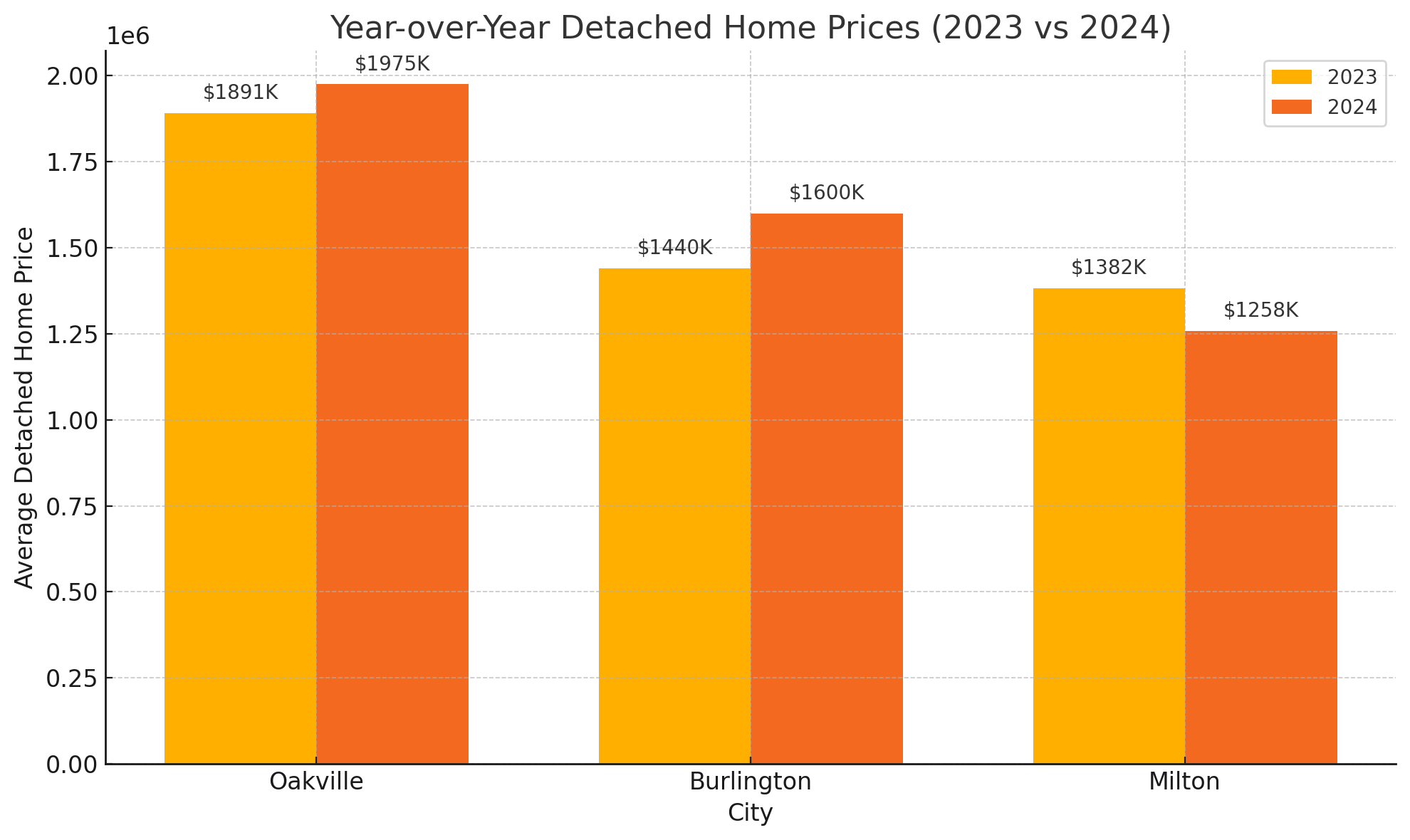

Yes, on a national level, average home prices are down about 3% year over year, but real estate is local—and our local markets tell a very different story:

Detached Home Prices, Year Over Year:

-

Oakville: up from $1,891,000 → $1,975,000

-

Burlington: up from $1,440,000 → $1,600,000

-

Milton: down from $1,382,000 → $1,258,000

So, in Oakville and Burlington, waiting actually cost buyers more—those markets increased in value. In Milton, prices did come down by about 9%, but if you were renting at $5,000/month while waiting, that’s $60,000 gone to rent—essentially equal to the price drop, with nothing to show for it.

The Takeaway?

Waiting only “works” if prices fall faster than the cost of renting—and that’s not happening in most parts of the GTA. Real estate is not just about timing the market; it’s about time in the market. While renters wait for the perfect moment, buyers are building equity, paying down their mortgages, and locking in their homes.

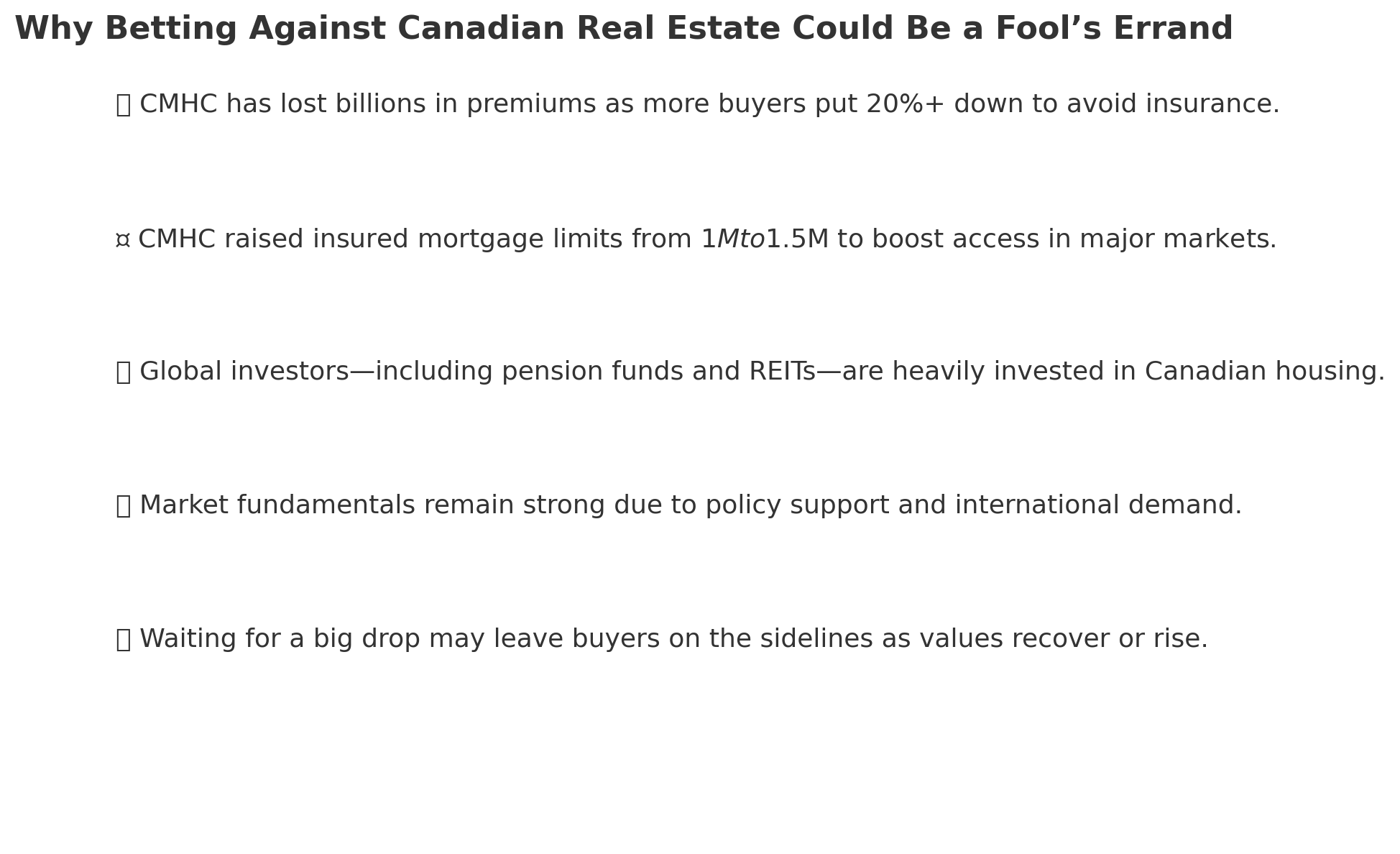

Why Betting Against Canadian Real Estate Could Be a Fool’s Errand

Canada’s residential real estate market has long been regarded as one of the most stable and desirable in the world. While there are always ups and downs, it’s worth paying attention to the underlying forces that continue to support its strength.

A Shift in Buyer Behaviour—and a Policy Response

One significant change over the past few years is that more buyers are choosing to put 20% down or more, bypassing the need for mortgage default insurance. This shift has impacted CMHC (Canada Mortgage and Housing Corporation), which has seen billions in lost premiums as fewer buyers opt for insured mortgages.

In response, CMHC has now increased the insured mortgage threshold from $1,000,000 to $1,500,000, making insured products more accessible to a broader range of buyers. This move isn't just about recovering lost revenue—it’s about ensuring continued access to homeownership in major urban markets where the average home price often exceeds the previous limit.

International and Institutional Interest

Canadian residential real estate is more than just a local market—it’s a global asset class. Pension funds, REITs, foreign investors, and even government-linked entities have significant exposure to this market. These institutions have a vested interest in the long-term health and stability of the Canadian housing system.

Whether for income stability, long-term growth, or capital preservation, the success of Canadian housing is aligned with the interests of powerful players both here and abroad. These backers provide additional ballast to the market, helping mitigate volatility and encouraging long-term confidence.

The Takeaway

With significant domestic demand, global investment interest, and policy decisions designed to support liquidity and access, betting against Canadian real estate is not a position to take lightly. While short-term corrections may happen, the long-term fundamentals remain robust.

For buyers sitting on the sidelines, it’s important to separate market noise from real trends. In a market supported by both policy and investment capital, waiting too long might mean being priced out entirely.